puerto rico tax break

Avoiding what he sees as unnecessarily high taxes in the Golden State in favor of Puerto Ricos considerable tax breaks. The key to all this is that Puerto Rican income is exempt from US federal income tax.

Puerto Rico Taxes How To Benefit From Incredible Tax Incentives Global Expat Advisors

The government says Puerto Rico needs the.

. The incentives were intended to lure high net-worth individuals and businesses particularly crypto investors. If youre a bona fide resident and have to file a US. Salvador Casellas a federal judge and former treasury secretary of Puerto Rico was a leader in lobbying for manufacturing tax breaks in the 1970s during a crisis that echoes.

The tax breaks fall under a law known as Act 60 a version of which was initially enacted by the Puerto Rico government under another name in 2012 as the island faced a looming economic collapse. Cryptocurrency traders hedge-fund managers and wealthy individuals have been exiting the mainland to Puerto Rico to avoid President Bidens proposed increases on capital-gains tax. For years the wealthy have swarmed to Puerto Rico to profit off of tax exemptions that dont extend to native Puerto Ricans and while the island is still in an economic crisis there are concerns that.

Puerto Ricos resident investor incentive commonly known as Act 22 lures wealthy individuals with the promise of legally. Lets look at Puerto Rico and take a guess at how long these tax incentives will stick around. Bitcoin enthusiasts are flocking to Puerto Rico thanks to tax breaks and an island lifestyle.

Yet it was Democratic Party leadership in Congress that instigated and for decades perpetuated Puerto. A growing number of wealthy outsiders are moving to Puerto Rico to take advantage of the islands tax breaks. Known as Act 60 previously Acts 20 and 22 Americans who move a qualifying business to Puerto Rico including becoming a Bona Fide resident and establishing an office in Puerto Rico will pay just 4 corporation tax and no tax on capital gains dividends interest and royalties.

Congressional Democrats Oppose Tax Breaks for Wealthy in Puerto Rico. 6 Often Overlooked Tax Breaks You Wouldnt Want to Miss. Legally avoiding the 37 federal rate and the 133 California or other state rate sounds pretty good.

Manufacturing companies to avoid corporate income taxes on profits made in US. For the right business and if set up properly this can lead to significant tax savings. Puerto Rico Offers Huge Tax Breaks and the IRS is Hot On the Trail.

Act 22 is for individuals. Act 22 Puerto Rico Individual Investors Act which introduced zero tax on capital gains and passive investment income like dividends. The special rules in Puerto Rico are simply a matter of Puerto Rican law which can be changed with the stroke of a pen.

Territories including Puerto Rico. 1 the 4 corporate tax rate has existed for decades and lasts potentially decades into the future. Paul is not alone.

One of those tax breaks enacted in 1976 allowed US. The IRS have begun auditing individuals who moved to Puerto Rico to take advantage of the tax incentives that began in 2012. If youre a bona fide resident of Puerto Rico youll be able to exclude income from Puerto Rican sources on your US.

You have to move to Puerto Rico to qualify. HISTORY OF CRISIS. Puerto Rico a US.

Territory is also a tax haven. But after the crash of 2008 the Puerto Rican economy never recovered so the government offered these incentives to attract investors and entrepreneurs. Act 20 is for companies.

As the community grows its attracting more newcomers from the states as well as curious locals. You have to pay yourself a normal base salary. Relative to the Made-In-America tax break the Made-in-Puerto Rico tax break has significant advantages.

With its generous financial incentives the territory is also a haven for wealthy Americans seeking to legally avoid. Puerto Rico has a mountain of debt which has tripled in. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund.

Income taxation doesnt apply to amounts you receive for services performed as an employee of the United States or any agency thereof. Posted on March 28 2022 by nhadmin. Learn More at AARP.

It confers a 100 tax holiday on passive income and capital gains for 20 years. Super-Rich Headed to Puerto Rico With an Eye on Tax Breaks Jun 8 2021 Blog Because Puerto Rico offers substantial tax advantages a new trend has begun. The one catch is that anyone working at a family office that relocates to Puerto Rico would have to spend at least half the year on the island or they lose the tax break.

Tax Breaks for Crypto Millionaires Stir Outrage in Puerto Rico. Read more about Puerto Rico taxes and how to qualify for these tax breaks in Part One of our Puerto Rico tax series. That didnt matter before because Puerto Rican taxes were just as high as US taxes.

Still Puerto Rico hopes to lure American mainlanders with an income tax of only 4. Private wealth clients hedge fund managers and cryptocurrency traders fleeing to Puerto Rico for its huge tax breaksand to escape President Joe. Financial advisory firm GenTrust seeks Puerto Rico tax breaks.

However this exemption from US. Not just azure waters and pristine beaches make Puerto Rico an attractive destination. It gives owners of incented new Puerto Rican companies a 34 tax on dividended income.

In 2019 the Puerto Rican government combined these laws and renamed them Act 60. Recent press reports confirm Bernie Sanders and Elizabeth Warren are among 34 Democratic Party leaders in Congress opposing tax shelters for the super rich in Puerto Rico. And 2 the tax rate is for goods and services produced in PR and sold anywhere in the world including in the US.

The zero tax rate covers both short-term and long-term capital gains. Written by Diane Kennedy CPA on June 4 2021.

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Faqs Tax Incentives And Moving To Puerto Rico

Puerto Rico Income Tax Return Prepare Mail Tax Forms

Puerto Rico Offers The Lowest Effective Corporate Income Tax

Tax Weary Americans Find Haven In Puerto Rico Frost Law Washington Dc

Should You Be Moving To Puerto Rico To Save Tax Global Expat Advisors

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Do Puerto Ricans Pay U S Taxes H R Block

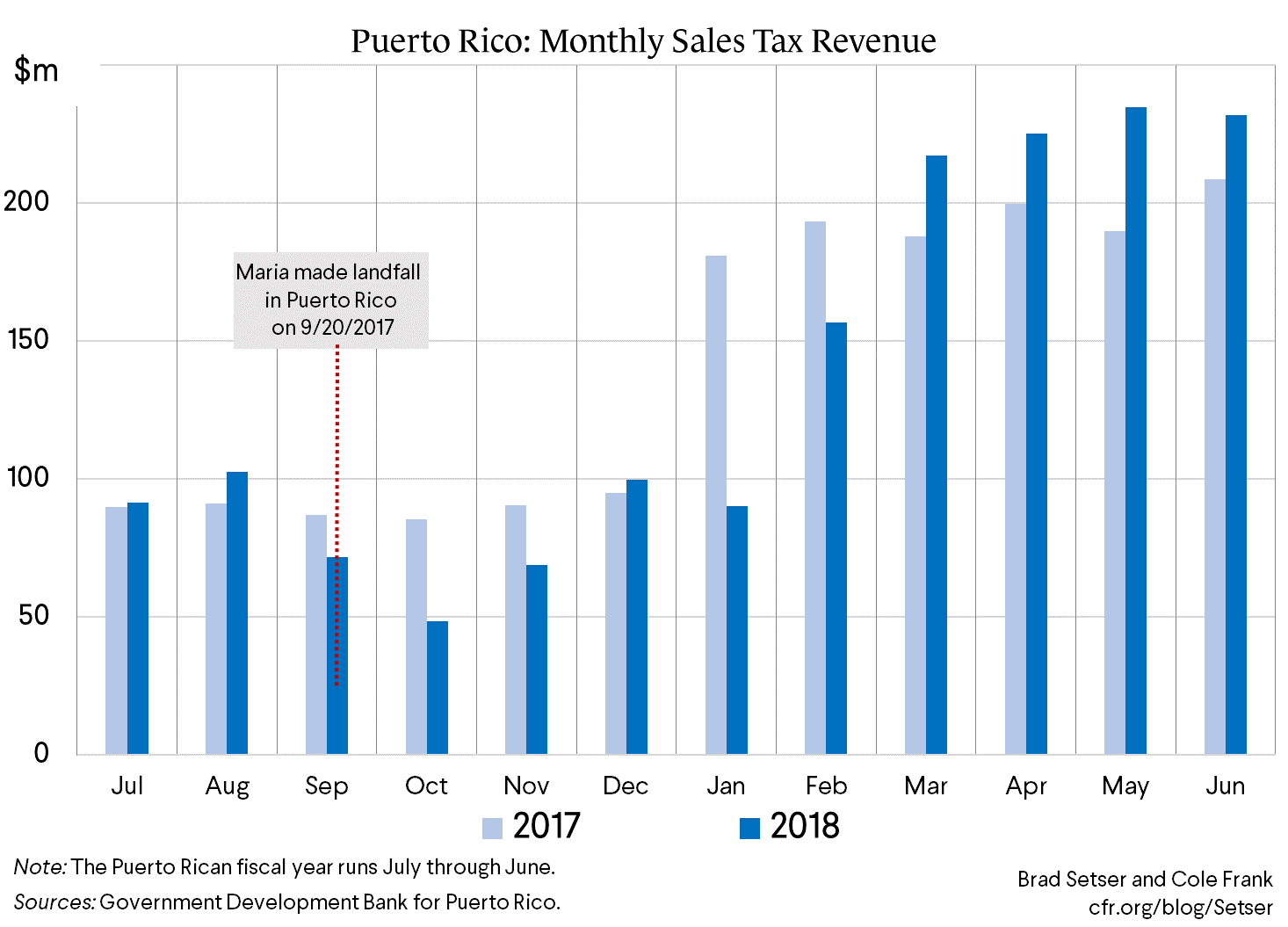

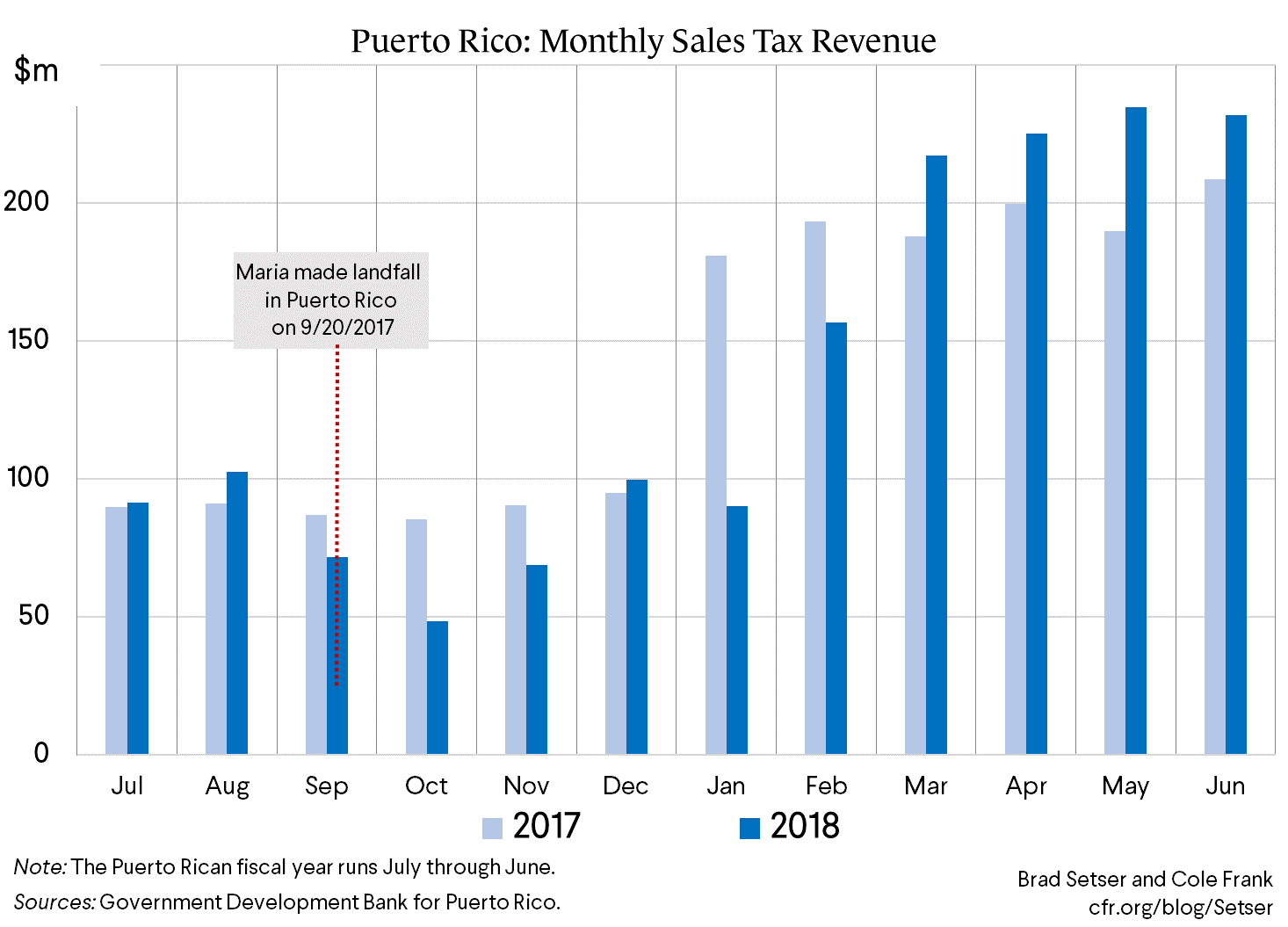

Looking Back On Fiscal 2018 As Puerto Rico Starts A New Fiscal Year Council On Foreign Relations

Puerto Rico Tourism Hits Record In 2021 Biz Latin Hub

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

Crypto Rich Are Moving To Puerto Rico World S New Luxury Tax Haven Bloomberg

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

Puerto Rico Luring Buyers With Tax Breaks The New York Times

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Us Tax Filing And Advantages For Americans Living In Puerto Rico

Puerto Rican Beach Parties Protest Public Beach Buy Up The Mary Sue